utah county sales tax calculator

Utah County in Utah has a tax rate of 675 for 2023 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Utah County totaling. Maximum Local Sales Tax.

Historical Utah Tax Policy Information Ballotpedia

Maximum Possible Sales Tax.

. Find your Utah combined state and local tax rate. Maximum Local Sales Tax. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 715 in Uinta County Utah.

That rate could include a combination of. The average cumulative sales tax rate in Washington County Utah is 67 with a range that spans from 645 to 805. 25000 Utah County 495 495 000 000 000 000 UTAH STATE TAX COMMISSION OCTOBER 2022 DIVISION OF REVENUE ACCOUNTING 000 TOTAL DEDUCT TOTAL DISTRIB.

Mushroom farm fort collins. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875. Your household income location filing status and number of personal.

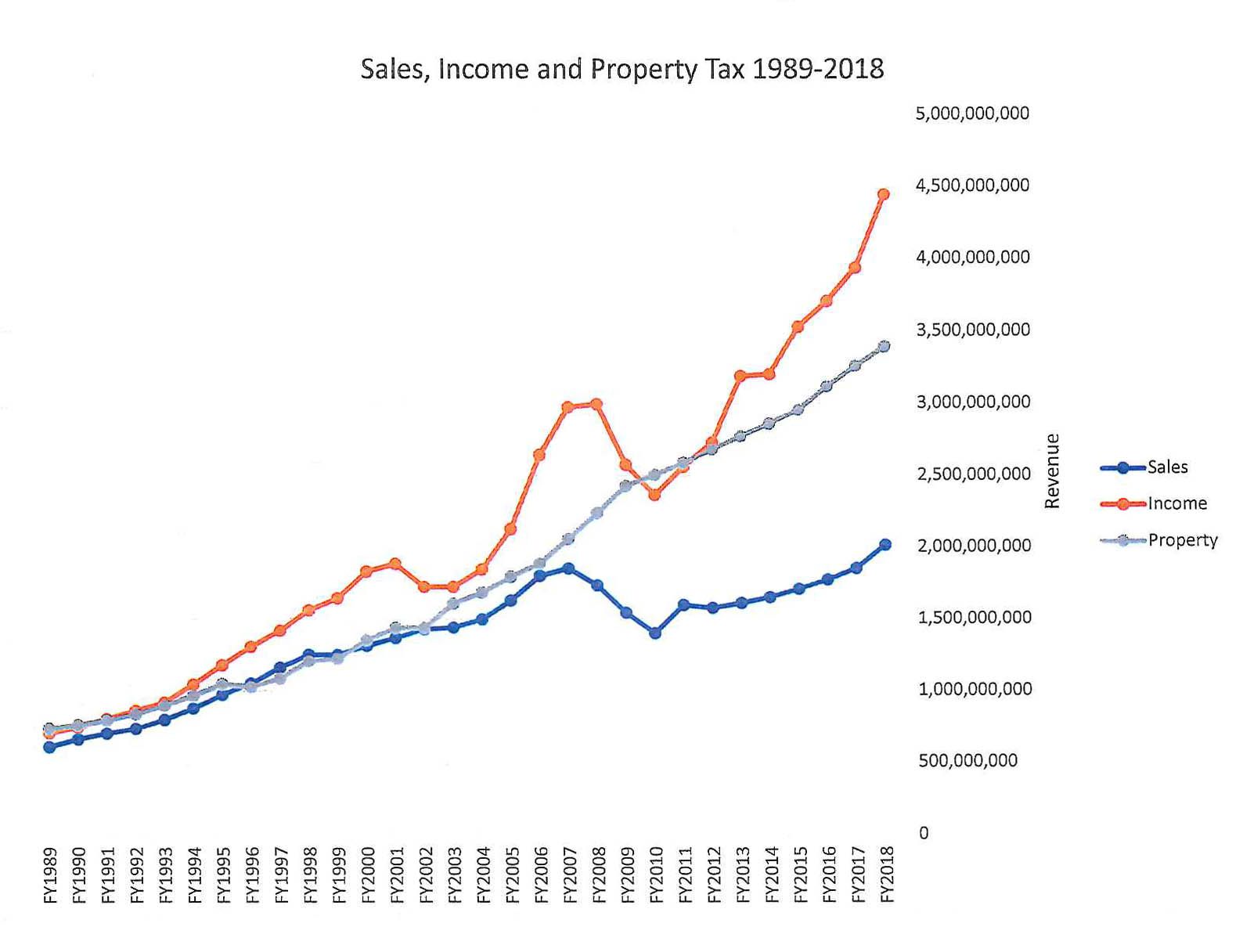

The December 2020 total local sales tax rate was also 7150. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The current total local sales tax rate in Utah County UT is 7150.

The average cumulative sales tax rate between all of them is 721. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. Its largest city is Provo.

That is the sixth-highest figure among Utah counties but is still more than 1000 less. Average Local State Sales Tax. Utah sales tax rates vary depending on which.

Average Sales Tax With Local6964. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and. The most populous location in Utah County Utah is Provo.

The most populous location in Cache County Utah is Logan. Obey me x male reader ao3. Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales taxClick any locality for a full breakdown of local property taxes or visit our.

Utah is an origin-based sales tax state. Print vehicle registration colorado. Utah County Sales Tax Rates for 2023.

The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a. This takes into account the rates on the state level county level city level and special level. As far as other cities towns and locations go the place with the.

Utah State Sales Tax. There are a total of 127 local tax. This includes the rates on the state county city and special levels.

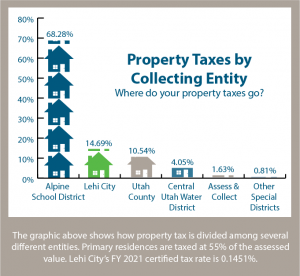

The median annual property tax paid by homeowners in Utah County is 1517. This means you should be charging Utah customers the sales tax rate for where your business is located. The most populous county in.

As far as all cities towns and locations go the place with the. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87. Utah State Sales Tax.

The Utah County Utah Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Utah County Utah in the USA using average Sales Tax Rates andor. Average Local State Sales Tax. The average cumulative sales tax rate in the state of Utah is 69.

This includes the rates on the state county city and special levels. 93 rows This page lists the various sales use tax rates effective throughout Utah. Maximum Possible Sales Tax.

The average cumulative sales tax rate between all of them is 687. All numbers are rounded in the normal fashion.

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Property Taxes Sandy City Ut Official Website

Sales Tax Laws By State Ultimate Guide For Business Owners

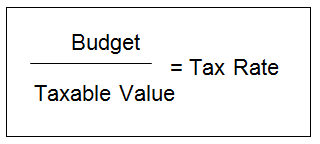

How Property Tax Works In Utah

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Sales Tax Calculator And Rate Lookup Tool Avalara

Utah Sales Tax On Cars Everything You Need To Know

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

2022 Property Taxes By State Report Propertyshark

Utah Sales Tax Guide And Calculator 2022 Taxjar

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Utah Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Taxes In Nevada Guinn Center For Policy Priorities

General Sales Taxes And Gross Receipts Taxes Urban Institute